This monthly newsletter provides updates on Ohio’s ongoing utility corruption scandal. Was this forwarded to you? Click here to subscribe.

Pretrial fact-finding is temporarily on hold in a federal class action related to Ohio’s nuclear and coal bailout law, House Bill 6. How long the stay continues will affect whether and when plaintiffs’ lawyers can question Lt. Gov. Jon Husted and other witnesses under oath, get a FirstEnergy company investigation report, and do other pretrial discovery.

Additional developments over the past several weeks include:

- FirstEnergy wants to conduct interim auctions to buy electricity for ratepayers who don’t otherwise have a supplier while its case to tweak that process and to extend and increase rider charges for all customers continues.

- FirstEnergy also wants to delay the evidentiary hearing for a grid modernization case by about six weeks, saying the added time could help settlement talks. The Office of the Ohio Consumers’ Counsel doesn’t want the case to move ahead at all until the company shows actual benefits to consumers from $600 million spent under an earlier case.

- Company lawyers say a sale of petroleum-based power plants should clear the way for federal regulators to approve a $6.3 billion deal between Vistra Corp and Energy Harbor for the two nuclear power plants involved in the HB 6 scandal.

- Production and review of documents is moving ahead in the federal government’s criminal case against Sam Randazzo, who formerly chaired the Public Utilities Commission of Ohio.

On hold

A December 1 order temporarily put pre-trial fact-finding on hold in FirstEnergy shareholder cases until the court rules on whether to stay discovery for a longer time while an appeals court reviews the case’s class action status. Class actions typically present larger financial exposure for a company and its leadership than cases that don’t have that certification.

Special Master Shawn Judge scheduled oral argument on FirstEnergy’s motion for that longer stay for January 4. After hearing from the parties’ lawyers that day, he will prepare a report and recommendations for U.S. District Court Judge Algenon Marbley. Under federal court rules, the judge has discretion whether to stay discovery and other trial court proceedings during the appeal.

If the court grants FirstEnergy’s request, plaintiffs would have to wait until late 2024 or afterward to question Lt. Gov. Jon Husted and other fact witnesses under oath, get the report on FirstEnergy’s internal investigation on matters related to HB 6, and do other pretrial fact-finding.

FirstEnergy’s lawyers contend the extended stay could save time and expense by limiting the scope of that discovery or rejecting the class certification altogether. A Dec. 19 brief by plaintiffs’ lawyers dismisses those concerns.

“Delay will be particularly prejudicial at this stage of the case, when a substantial number of depositions have been scheduled in the next few months,” the brief added. Some witnesses have already testified to forgetting various details, the lawyers added, with references to parts of pre-trial testimony by Jason Lisowski, who is FirstEnergy’s controller and chief accounting officer, as well as former executives Mike Dowling, James Pearson and Steven Strah.

A separate FirstEnergy filing on Dec. 20 objected to the special master’s order requiring it to produce an internal investigation report relating to HB 6, arguing that the report is privileged. Energy Harbor also objected on Dec. 11 to a special master’s order calling for it to produce additional materials to the plaintiffs.

Sam Randazzo, a former chair of the Public Utilities Commission of Ohio who now faces criminal charges related to HB 6, has also objected to producing additional materials to the plaintiffs’ lawyers under a Nov. 6 special master’s order. A separate order says Randazzo doesn’t have to comply until the court rules on his objections, his lawyer Roger Sugarman noted.

Read more:

- FirstEnergy investor class action will get appellate review in multibillion case (Reuters)

- Energy company paid $43M for dirty bailout. Says it acted in a “legal way” (Ohio Capital Journal)

Dinner talk?

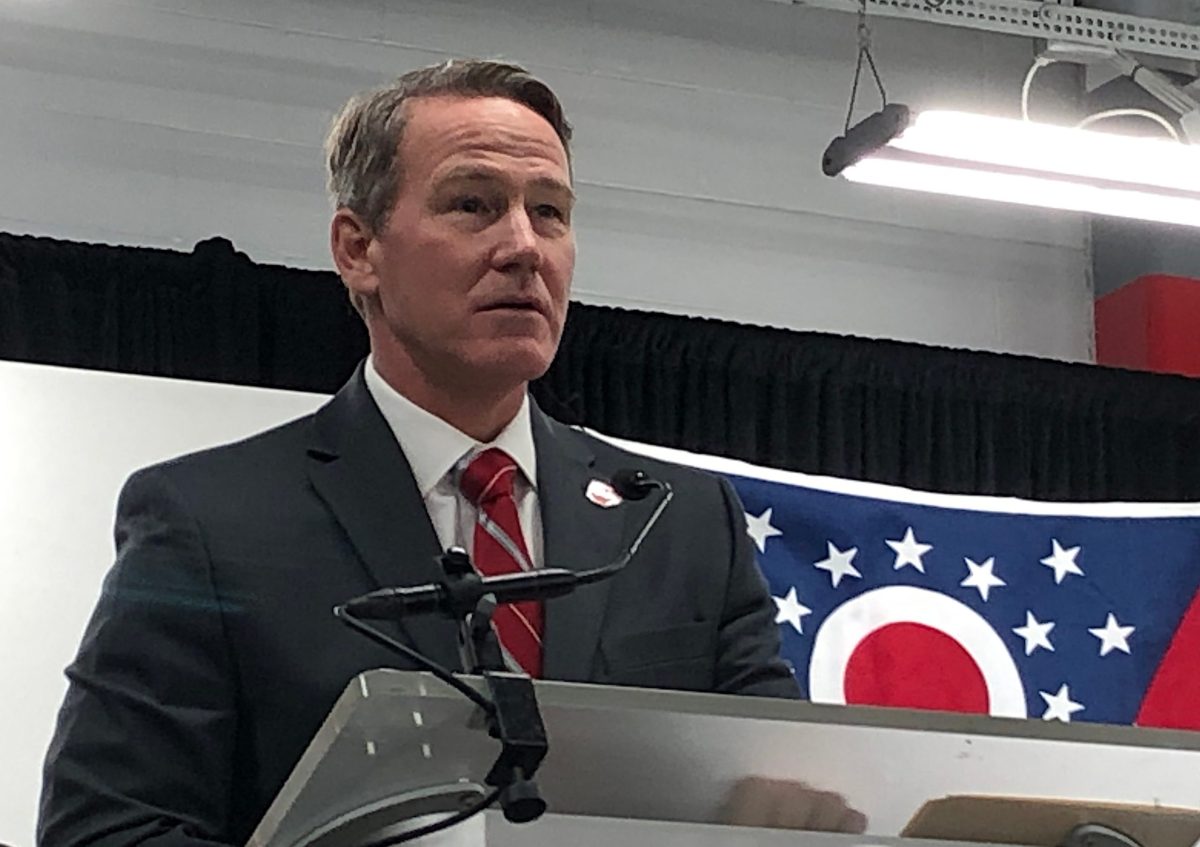

If and when the shareholder plaintiffs get to question Husted under oath, one likely line of questioning will be a December 2018 dinner he attended with then governor-elect Mike DeWine, Dowling and former FirstEnergy CEO Chuck Jones Weeks later, DeWine appointed Sam Randazzo as chair of the Public Utilities Commission of Ohio. A text from Jones to Randazzo the next day noted the open PUCO seat was among the dinner conversation topics.

When asked what was discussed at the dinner, Husted’s spokesperson Hayley Carducci said in 2021 that the governor had addressed it, despite DeWine claiming in a press conference that he couldn’t recall. Husted’s spokesperson avoided the question when the Energy News Network posed it again last month, deferring instead to DeWine’s press secretary, who gave only a general statement on the Randazzo indictment.

Husted and DeWine’s office have already produced documents in response to the shareholder plaintiffs’ subpoenas. A deposition could provide more details about information in those materials. Another likely line of inquiry would be Husted’s apparent role in pushing for a longer bailout for the former FirstEnergy nuclear plants, as reflected in exhibits from last year’s criminal trial of former Ohio House speaker Larry Householder.

Other questions might arise about a possible meeting with Jones in September 2019. At the time, opponents were trying to get a referendum on the ballot to repeal HB 6.

Husted told ABC affiliate WTVG last month that everything he knows “has already been turned over years ago.”

Read more:

- Husted to be deposed, DeWine subpoenaed in lawsuit over FirstEnergy bribery scheme (Cleveland.com)

- Husted discusses deposition in upcoming FirstEnergy bribery lawsuit (ABC/WTVG)

- Nothing new? Records show startling new info on DeWine, Husted roles in Ohio bailout scandal (Ohio Capital Journal)

FirstEnergy riders

FirstEnergy wants regulators to greenlight interim auctions so the company can buy electricity for non-shopping customers while its combined case continues on proposed changes to the auction process and requests for rider charges. Non-shopping customers are ratepayers who don’t otherwise have an energy supplier through their own shopping choice or through a community aggregation program.

The PUCO probably won’t decide on the auction and rider issues in the case before sometime in February, FirstEnergy spokesperson Jennifer Young said. Even that may be ambitious. Parties’ initial briefs are due Jan. 19, and reply briefs don’t need to be filed until Feb. 9.

However, the current “standard service offer” — the terms for non-shopping customers — runs out on May 31. And it takes time to provide required notice to potential bidders. With that in mind, the company plans to conduct one auction in late January or early February and another between mid-March and early April.

So far, no parties in the case have opposed the Dec. 13 request, although the PUCO staff suggested a tweak to account for a commission ruling in an American Electric Power case.

The Office of the Ohio Consumers’ Counsel, the Northwest Ohio Aggregation Council and the Ohio Manufacturers’ Association Energy Group even enthusiastically supported FirstEnergy’s request. From their standpoint, that fits with their Dec. 6 request to stay a delivery capital recovery rider in light of Randazzo’s criminal indictment, which was announced on Dec. 4. The same rider is at issue in one of four HB 6-linked cases that have been frozen since August 2022.

The request to put at least one of the FirstEnergy riders on hold in light of the indictment echoes themes from prior requests by multiple parties for the PUCO to take a closer look at issues and review cases where Randazzo played a role. So far the PUCO has not indicated it would conduct such a review.

Even if the PUCO ruled on all the issues in the rider case by late February, any requests for reconsideration may not be resolved before May, when FirstEnergy is due to file a full rate case. Various parties have objected to all the riders in the current case, noting among other things that they should be considered in that full rate case, which is supposed to consider all the FirstEnergy utilities’ anticipated costs and revenues.

Read more:

- Randazzo indictment sparks renewed calls for full regulatory review in Ohio (Energy News Network)

FirstEnergy grid cases

FirstEnergy also wants regulators to delay the evidentiary hearing for a grid modernization case, referred to as Grid Mod II, which was set to start on Jan. 16. The company’s Dec. 21 filing said extra time could help settlement talks.

The Consumers’ Counsel has said the PUCO shouldn’t let FirstEnergy get any money for the proposals until the company shows actual benefits to consumers from $600 million spent in an earlier case, known as Grid Mod I.

A Nov. 2022 audit in the earlier case by Daymark Energy Advisors found multiple shortcomings in how FirstEnergy calculated and tracked operational benefits from those investments. A year later, the PUCO accepted the audit and told FirstEnergy to implement its recommendations in the Grid Mod II case. The Consumers’ Counsel has asked for reconsideration of that order.

Even if a settlement takes place in the Grid Mod II case, it’s unclear whether all parties would join. Prior settlements have come under scrutiny where it appears certain parties got side deals not available to ratepayers generally. That includes the prior FirstEnergy rider case that gave rise to the Grid Mod I and Grid Mod II cases.

Aside from issues raised in the Daymark audit, the Grid Mod II case presents questions about whether those investments will maximize efficiencies for consumers.

One example is incentives for smart thermostats, said Nolan Rutschilling, managing director of energy policy for the Ohio Environmental Council. Without a demand response program that would cycle participating customers’ air conditioning on and off during periods of high demand, the grid would continue to face high stress during extreme heat events, and ratepayers would miss out on a lot of energy savings, he said.

Prehearing testimony by John Seryak, a RunnerStone analyst acting as an expert witness for the Ohio Manufacturers’ Association Energy Group, also raised concerns about FirstEnergy’s proposals to own a battery energy storage system and for an electric vehicle charging pilot.

Energy Harbor deal

The Federal Energy Regulatory Commission plans to rule by April on a proposed $6.3 billion deal between Vistra Corp. and Energy Harbor, the bankruptcy successor to FirstEnergy Solutions. Under the deal, the two nuclear power plants at the center of the HB 6 scandal would be transferred to a new subsidiary, Vistra Vision.

Vistra Corp.’s lawyers advised FERC on Dec. 18 that the company had made a deal to sell Richland-Stryker Generation, which owns two petroleum peaker plants, to an unrelated party. The company has said that step should remove concerns about reduced competition and market control. However, previous filings by PJM’s Independent Market Monitor and the Office of the Ohio Consumers’ Counsel have said they would continue to have concerns about concentrated market power in the Ohio service area even if the sale takes place.

Testimony from the Householder and Borges trial last Feb. 14 suggested a long-range goal of selling the Davis-Besse and Perry nuclear plants. Juan Cespedes, a lobbyist for FirstEnergy Solutions, testified that the right-hand assistant to John Kiani, Energy Harbor’s chair, inferred Kiani personally stood to make roughly $100 million from a sale of the plants. Kiani had been an activist investor who operated a hedge fund, and he and others had invested in FirstEnergy Solutions, Cespedes said on Feb. 13.

Energy Harbor’s media contact Todd Morgano has not responded to a request for comment.

Read more:

- FERC extends review of Vistra-Energy Harbor merger, delaying $6.3B deal’s potential close (Utility Dive)

- Nuclear exec would have made $100 million from sale of plants at heart of bribery trial, lobbyist says (Cleveland.com)

- Utility and fossil fuel interests still ahead in Ohio under House Bill 6 (Energy News Network)

Criminal cases

Trial has not yet been set for former PUCO chair Sam Randazzo, who has been indicted on 11 counts of bribery and embezzlement. Randazzo has pled not guilty. The case is before U.S. District Court Judge Timothy Black, who presided over the criminal trial of former Ohio House speaker Larry Householder and lobbyist Matt Borges last year. Both have appealed their criminal convictions, although neither has yet filed their merits brief with the Sixth Circuit Court of Appeals.

The government’s production of documents and review of those materials by Randazzo’s lawyers is now underway. The next pretrial status conference will be on Jan. 16.

So far, the Department of Justice has not filed criminal charges against any present or former executives of FirstEnergy and its former subsidiary FirstEnergy Solutions.

Read more:

- Former PUCO chairman Sam Randazzo indicted on bribery, fraud charges in federal court (Cincinnati Enquirer)

- Former chair of Ohio’s utility regulator indicted in nuclear bailout law scandal (Statehouse News)

- Former PUCO chair pleads not guilty for his alleged part in FirstEnergy scandal (Ohio Capital Journal)

- Former top utility regulator Randazzo, handcuffed before a judge, pleads not guilty (Cleveland.com)